Hi everybody, I'm back for a step to let recap on step one. Step one, I will show you how to form a limited liability company or if you want to form a nonprofit organization like a church. I will also help you know how to have people involved in this nonprofit organization. Now, in step 1, you will just show your business name and form an LLC (limited liability company). They will give you a certificate with a ten-digit number. You will need this number for your website. So, why did you do step one? You did it because you need a name for your organization. You need to form your business and let the state or the government know that you are doing business. In the United States, you have to register the name and the business. Now, you have your certificate with the ten-digit number on it. Now you are ready to go to the next step. You cannot escape or skip the first step. You must follow step by step. If you go directly to the second step, you know what will happen. You will miss out on getting the ten-digit number for your limited liability company from the state. Now, let's go back to number two. In number two, you need an employer identification number, even though you have no employees. You are working for yourself. You are working only for you. However, if your business starts to grow and you need help, you may need to hire employees. This is not the focus of today's tutorial. Step two requires a number, which will give you a nine-digit employer identification number. You will need this number to file your taxes. Sorry, but there are no other sentences detected in the provided text.

Award-winning PDF software

How to get a copy of your ss4 online Form: What You Should Know

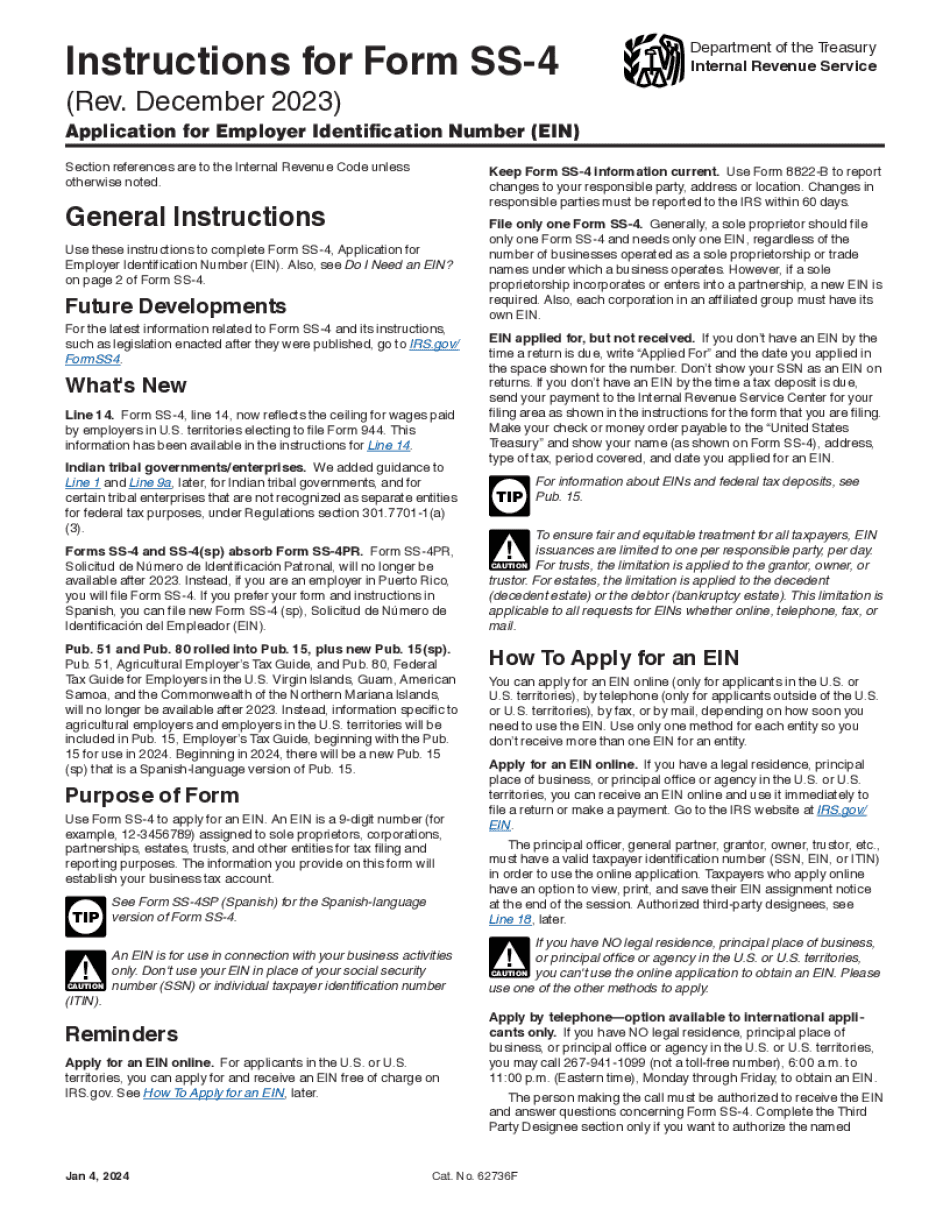

Use Form SS-4 to apply for an employer identification number (EIN). Use Form 8822-B to report changes to your responsible party, address or location. Form SS-4 (Rev. December 2019) — IRS ▷ Go to for instructions and the latest information. ▷ See separate instructions for each line. ▷ Keep a copy for your records. OMB No. ▷ Go to to request a new or replacement SS-4 from the IRS. ▷ For complete information on what to do with your lost or stolen SS-4. Visit the IRS .gov website. How Do I Get a Copy of My Tax Return with an EIN? — Nav March 4, 2025 — The IRS provides Form SS-4 for employers, tax law returns and business owners for filing reports of corporate ownership; filing a report of partnership ownership, filing Forms 14C and 15C, or filing Form 8822-B. A new tax law for 2018, called Internal Revenue Code of 1986, changed how employers must file an SS-4. Form SS-4 (Rev. December 2019) — IRS ▷ Go to to submit your Form SS-4 for your tax returns. The online form will ask you to select all the boxes that apply to your situation. You can also mail your Form SS-4 to the address on the form. The EIN will be sent to the address supplied on the form. OMB No. ▷ Go to to request a new or replacement SS-4 from the IRS. ▷ For complete information on what to do with your lost or stolen SS-4. Visit the IRS .gov website. How Do I Use an SS-4 to File? — Nav Opinion / Analysis The IRS has given us this list of things you must do if you do not have an EIN. Now they are telling us what to do if we do, in addition to making changes. I guess it may be a good idea to read this carefully before they change it or change it and then take up these changes. They are also taking a step to make it even more confusing.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions Ss-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions Ss-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions Ss-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions Ss-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to get a copy of your ss4 online